I’ll start with my framework for evaluating companies. A company’s potential is a function of its probability of success and their expected outcome size. In other words, how big can this company be and how likely is it to get there?

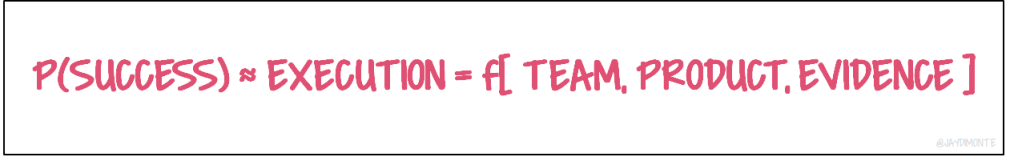

Probability of success is a function of a company’s ability to execute.

Execution is all about team but what they build (product) and how they sell it (evidence of success) are indicators of how the company is executing.

Key elements here:

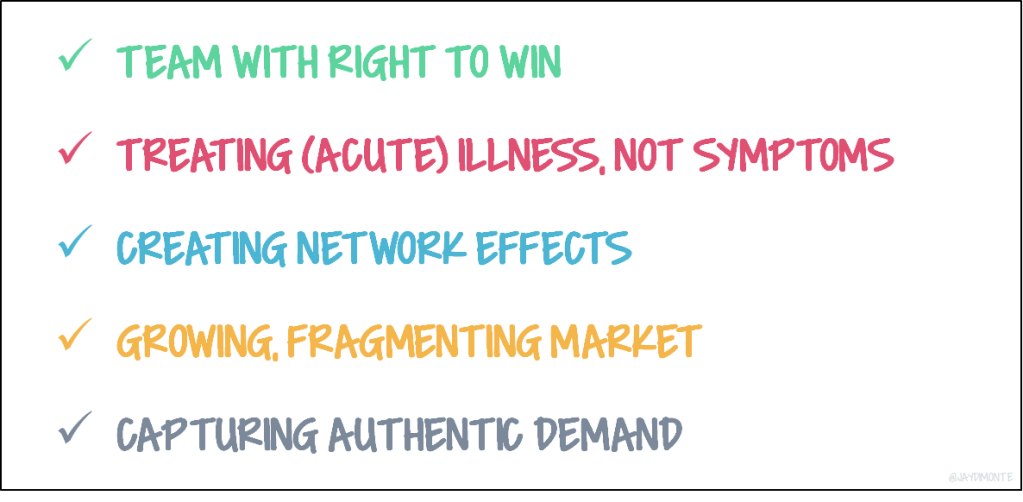

- Team: Has a reason to win in the market. This includes industry expertise, a unique insight, operating experience or another attribute. They have the ability to recruit and surround themselves with interesting talent. I like to answer the question, “work I work for them?” because in essence, I will!

- Product: Does the product drive network effects? The strongest network effects are among fragmented entities (inter-company or social group) and weakest are across entities (intra-company or social group), but I look for them to exist. Network effects drive stickiness. Many times they are coupled with virality but not always. Virality drives down acquisition costs. I love companies with under-optimized products that are over-utilized. It’s a way of identifying authentic demand.

- Evidence of success: I look for high net retention and am excited if there is room for expansion. Both dollar and logo retention is important, but having correlation is most important at the early stage. Can you retain and grow your most profitable customers?

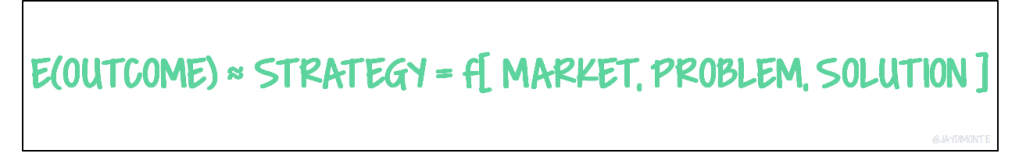

The expected outcome is largely driven by a company’s strategy. The biggest strategic advantage is driven by market. The problem needs to be high priority and solution sought after.

- Market: The most interesting markets are growing and fragmented (or large and ready for disruption). I am looking for $B+ market sizes. Ideally the company creates an expanding market. If they are starting niche and growing, I look for expansion driven by:

- Tangent product to same customer base

- Same product to tangent customer base

- Problem: Is the pain point acute and a top 1-3 concern? Yes, boredom, fulfillment, and connection can be top concerns for consumers. Nice-to-have’s don’t cut it in enterprise. Bonus points if the problem is measurable.

- Solution: Are we treating the illness or the symptom? I prefer solutions that address the root of the problem. Sometimes solutions exist by have very low NPS. Sometimes substitutions exists but very few or no other competitors have found the right approach.

Must have checklist:

Leave a comment